Stay on top of your customers’ complaints and learn more about their most common frustrations.

Banking

Live chat and banking chatbots your customers can count on

Enable self-service and signpost customers to your bank’s services with live chat and banking chatbots.

Deploy a chatbot to answer 80% of bank inquiries day and night on all your digital channels.

Use our live chat solution to auto-translate questions and replies, making your bank’s contact centre fluent in over 120 languages.

Live chat and banking chatbots your customers can count on

Enable self-service and signpost customers to your bank’s services with live chat and banking chatbots.

Deploy a chatbot to answer 80% of bank inquiries day and night on all your digital channels.

Use our live chat solution to auto-translate questions and replies, making your bank’s contact centre fluent in over 120 languages.

Case studies

Title Number #1

Case studies

Title Number #2

Several years in the industry have given us invaluable knowledge in the field which we pride ourselves in.

Case studies

Title Number #3

We always guarantee a good quality of our services/projects to ensure that clients’ satisfaction is achieved.

Discover our live chat and chatbot features

Collect Feedback

Enjoy end-to-end security architecture with military-grade data encryption in transit and at rest.

Live Chat Handover

Seamlessly escalate complex conversations to your live agents.

Auto-translate queries and responses, making your live agents fluent in 120+ languages.

Omnichannel Support

Talk to your customers on any digital channel, from your website to WhatsApp and Facebook.

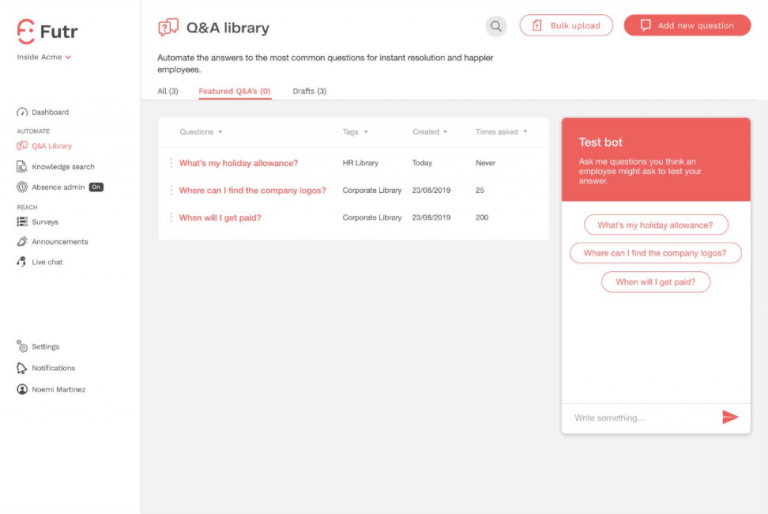

Provide instant answers to common questions 24/7

Bring self-service features to your banking customers

Over 80% of queries about bank services relate to just a handful of frequently asked questions.

Over 200 chatbot integrations for banks

Choose from 200+ chatbot integrations for banks and financial institutions.

Live chat superpowers for your customer service agents

Futr integrates with any live chat software to escalate urgent bank queries to your live agents.

Provide instant answers to common questions 24/7

Bring self-service features to your banking customers

Over 80% of queries about bank services relate to just a handful of frequently asked questions.

Over 200 chatbot integrations for banks

Choose from 200+ chatbot integrations for banks and financial institutions.

Live chat superpowers for your customer service agents

Futr integrates with any live chat software to escalate urgent bank queries to your live agents.

Automate correct answers before they’re even asked

Get started with AI banking live chat and AI chatbot technology built for humans, by humans. With Futr’s AI chatbot platform, you can stay ahead of your customers’ needs and automate correct answers before they’re even asked.

What is a chatbot?

A chatbot is a computer program designed to imitate and process human conversations on websites, apps and messaging platforms. Chatbots enable humans to communicate with digital devices as if they were interacting with a real person. They can use rudimentary rule-based programming to answer simple queries or sophisticated technology to function as digital assistants.

What can banking chatbots do?

At Futr, our banking chatbots use advanced algorithms to engage customers and respond to frequently asked questions in the banking sector. Our bank chatbots can also signpost to your bank’s services, allowing customers to:

– Find a branch

– Book an appointment

– Apply for a loan

– Change their contact information

– Cancel or freeze a card.

Does Futr offer a free trial?

Yes, Futr offers a free demo and a no-obligation four-week trial of our chatbot and live chat platform.

Does Futr offer live chat?

Yes, Futr’s live chat solution allows your bank’s customers to seamlessly escalate a conversation with a chatbot to one of your live agents. Out of hours, your chatbot can generate a ticket and connect a customer with a live agent the next business day.

Does Futr offer integrations?

Yes, we are experts at integrations. Futr’s live chat and chatbot platform integrate with your CRM, service desk and field management systems.

When it comes to the banking sector, Futr supports leading operations management and IT operations platforms, including SAP, Oracle, Intuit, Azure, DevOps, MySQL, MongoDB SQL Server and Git, among others.

What channels does Futr deploy to?

Our live chat and chatbot platform can be deployed as a pop-up on your website. You can also deploy a chatbot interface across your

customer support channels, including WhatsApp, Instagram and Facebook Messenger. We can also deploy chatbots to your organisation’s intranet channels, including Slack and Microsoft Teams.

What languages does Futr support?

Futr auto-translates queries and responses into 120 languages, including French, Spanish, Afrikaans, Pashto, Romanian and more.

Futr also supports Cymraeg/Welsh — a critical feature in Wales, where banks are required by law to provide services in Welsh and English.